November 12, 2025

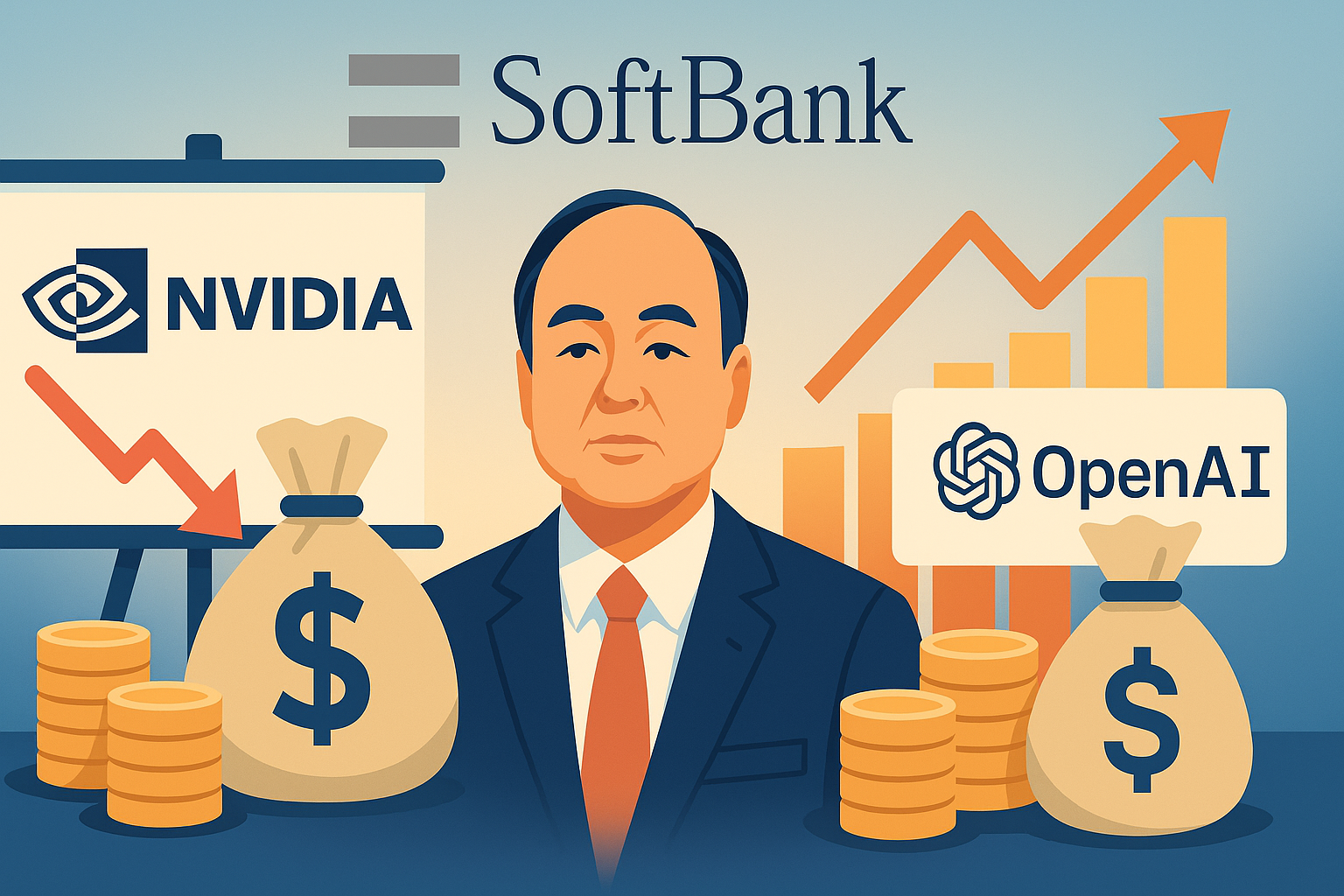

SoftBank has sold its entire stake in Nvidia, worth about US$5.8 billion, as part of a sweeping move by CEO Masayoshi Son to redirect capital toward artificial intelligence ventures—most notably, a massive investment in OpenAI.

The Tokyo-based investment conglomerate, best known for its early and highly profitable stake in Alibaba, operates the Vision Fund, one of the world’s largest technology investment portfolios. The sale of 32.1 million Nvidia shares in October marks the second time SoftBank has exited the chipmaker, after a similar divestment in 2019. The company said the move wasn’t driven by concerns over Nvidia’s performance, but by a strategic decision to fund what could become one of the largest private-sector AI investments on record.

According to Fortune and Reuters, SoftBank’s board has approved a US$22.5 billion first tranche toward a total commitment of up to US$30 billion, part of a US$40 billion syndicate round for OpenAI. The remaining capital may lift SoftBank’s total exposure to as high as US$34 billion by year-end, pending corporate restructuring at OpenAI ahead of a potential public listing.

The investments tie directly into the so-called Stargate project—a multi-partner, US$500 billion effort led by SoftBank, OpenAI and Oracle to build a network of next-generation data centres across the United States. The first of these sites has already gone live in Texas.

Nvidia shares fell roughly 2 per cent following the announcement, while SoftBank’s stock gained ground as investors increasingly view it as a proxy for OpenAI’s growth. Analysts say the shift underscores Son’s evolving strategy: moving from hardware and infrastructure toward AI platforms and applications.

The move fits a familiar pattern for the billionaire investor, who has made—and sometimes lost—fortunes on big bets in transformative technology. His wager this time, observers say, is that ownership of AI intelligence, not the chips that power it, will define the next generation of tech leaders.